The Bureau of Labor Statistics places financial 셔츠룸 알바 counselors who work for high-net-worth clientele in the same group as personal bankers and asset managers; however, the BLS does not officially collect salary data for asset managers. The BLS places financial counselors who work for high-net-worth clientele in the same group as personal bankers and asset managers. The Bureau of Labor Statistics classifies financial counselors who deal with high-net-worth clients alongside personal bankers and asset managers in the same occupational category. Personal bankers and asset managers are also considered possible service providers under this category. Private banking clients not only get advice on how to meet all of their diverse financial needs, but also customized care from their bankers. Customers who make use of these services have the opportunity to amass money, preserve it over the course of time, and pass it down to subsequent generations. Private bankers are the ones who are in charge of making investments on behalf of individual customers, whilst asset managers are in charge of making investments on behalf of institutional clients (and large groups of individual investors).

Private bankers employ the resources of the bank, which may include teams of financial analysts, accountants, and other professionals, to manage a range of assets for their clients under the umbrella term “portfolio.” These assets are referred to as “portfolio investments.” The term “portfolio” is used to refer to this collection of assets. These kinds of investments are sometimes referred to as “portfolio investments” when they are discussed in financial circles. For instance, the private wealth management division of Morgan Stanley and the investment advisors at Bel Air only work with individuals, families, and foundations that have at least $20 million in assets that they wish to invest. These clients can come from a variety of backgrounds, including business owners, charitable organizations, and more. Because of this rule, customers are protected from having their investments result in a loss of capital. Customers like this could come from a broad variety of various backgrounds, such as wealthy individuals, charity groups, or business owners. This clause was included into the agreement so that there would be no danger of competing interests arising from the situation. Advisors who are employed by financial investment companies or financial planning businesses, as well as those who are self-employed, frequently generate income by charging their customers a percentage of the assets that they manage on their clients’ behalf. This also applies to advisors who are employed by financial investment companies or financial planning businesses. This is also true for advisers who work for financial investment firms or organizations that specialize in financial planning. This is also a common operating practice for advisors who are recruited by companies or organizations that specialize in financial planning or financial investing.

The fees that are often charged by robo-advisors may range anywhere from 0.25 percent to 0.89 percent of the total value of the assets that are handled by the company. This is a significant reduction from the one to two percent that traditional consultants often want as payment for their services as payment for such services. In general, investors who have a lower total number of assets that are managed are liable for paying a higher proportion of the total value of those assets in the form of fees. This is because the costs are calculated as a percentage of the assets’ total worth. This is as a result of the fact that the sum total of the expenditures is calculated by applying a percentage to the overall worth of the assets. Because banks often charge fees as a percentage of the assets they manage, it is not profitable for them to court customers who have less than $200,000 worth of investable assets. This is because banks normally charge expenses as a part of the assets they manage. This is due to the fact that banks base their fees on a proportion of the total assets under their management. This is because banks base the fees they collect on a proportion of the assets that are under their administration, which explains why this is the case.

Wealth advisors are in a better position to charge actually lower percentage fees than the average financial consultant because they frequently work with clients who have larger families. This is because the average financial consultant works with families that have fewer assets under management. Wealth advisors frequently work with clients who have larger families. The reason for this is because customers with bigger families make up a significant portion of a financial advisor’s client base. This is due to the fact that wealth advisors often work with customers whose major emphasis is on providing for large families. It is possible for financial and wealth advisors to get payment in the form of set fees or a piece of the value of the portfolios that are handled by the advisers. Both of these options are viable forms of compensation. Both of these choices represent valid kinds of compensation that may be considered. Both of these frameworks are potentially viable solutions to examine. A comprehensive financial plan can be crafted by a financial advisor for a one-time fee ranging from $1,500 to $2,500, or the ongoing management of a client’s portfolio can be managed for approximately 1 percent of the client’s assets under management. Both of these options are available for a client. For the purpose of simplicity, both of these services are collectively referred to as “fees.” If you are interested in obtaining any of these services, your best bet is to consult with a financial consultant.

It is not beyond the range of possibilities for wealth managers to charge an hourly cost to their clients for any advisory services that they want to deliver. This might be done for a variety of reasons. One of the examples of one of these services is the construction of a financial plan for you to execute on your own. Another one of these services is the arranging of one-on-one meetings to discuss retirement planning, investment management, and other issues. In addition to that, they may also consist of developing a financial plan for you to implement on your own. It is standard practice for the staff at the company to participate in the process of both ensuring that strategies are executed based on the demands of the customers and the process of coaching customers on the variety of services that a money management company may provide. In addition, it is standard practice for the staff at the company to participate in the process of advising customers on the variety of services that a money management company may provide. Additionally, it is a common practice for the personnel at the firm to take part in the process of counseling consumers on the myriad of services that may be provided by a money management company. This is done as part of the normal operating procedure at the company. This is done as an important part of the process of ensuring that the plans are carried out in accordance with the needs of the customers, and it is done so as to ensure that the plans are carried out in accordance with the requirements of the clients. In point of fact, the junior asset manager will carry out the great majority of their encounters with consumers during the course of the telephone conversation. In addition to this, they will meet their clients in person, and the junior asset manager may even take their customers out for a night of drinks and chat as a complimentary gesture.

If a junior asset manager is putting in between 50 and 60 hours of work each week, this does not always mean that they are doing nothing but sitting at their desk the whole time. There are a variety of activities that may be taking place during this period. There are a variety of additional activities that kids can be participating in during this time period. When all is said and done, I would say that if you are not working in a role that is exclusively in the back office of a large, proprietary asset management firm, you are going to be chained to your desk for 30 to 40 hours per week, and you are going to be talking with clients, meeting clients, or going to events for another 20 to 30 hours per week. If you are not working in a role that is exclusively in the back office of a large, proprietary asset management firm, you are going to If you are not already employed in a position that is solely located in the back office of a major, privately held asset management company, you are likely to face the following challenges: If you are not currently working in a job that is completely based in the back office of a significant privately owned asset management organization, there is no chance that you will get promoted there. The example that follows is only one illustration of how I put the rule of thumb to use in general. Even at an entry-level position, it is common practice to spend the weekend working in a job that is related to money management by attending networking events with clients or hoping to meet clients while also performing a little bit of lighter housekeeping. This can be done either in the hope of meeting clients or in the hope of networking with clients. This is accomplished while spending a few hours each day attending activities geared at fostering professional relationships. In the field of financial management, a weekend like this one would look something like this as an illustration of a normal weekend commitment (such as cleaning out your email inbox, etc.). Even on the days when there is no work from clients that has to be completed, this continues to be the situation.

When working in investment banking, an MD does not really have the power to restrict the number of hours that they work; rather, they have a lot of leeway about when they work. MDs in investment banking have a great deal of flexibility when it comes to determining when they put in their work hours, as opposed to being told how many hours they must put in. On the other hand, if you work in the field of asset management, you almost certainly will be able to adjust your schedule so that it fits the kind of life you want to lead. Working in this sector comes with a substantial advantage in this regard. In contrast to this, the role of managing director (MD) in investment banking is such that an MD does not really have the power to decide how many hours their staff put in each week. On the other hand, managing directors in investment banking have a significant amount of wiggle room when it comes to the minimum number of hours that they are required to work each week in order to maintain their positions. This flexibility extends to the number of hours that they are expected to work. Wealth managers are responsible for managing their clients’ actual wealth, while financial planners are responsible for managing their clients’ day-to-day finances and assisting them in reaching their long-term financial goals. Wealth managers are responsible for managing their clients’ actual wealth, while financial planners are responsible for managing their clients’ day-to-day finances. While financial planners are responsible for managing their customers’ day-to-day finances, wealth managers are in charge of managing their clients’ real money. Wealth managers are also known as private bankers. The primary difference between a financial planner and a wealth manager is that wealth managers are liable for managing their clients’ actual money. Financial planners do not have this responsibility. The only thing that financial planners are accountable for is the future financial well-being of their customers. In contrast, the duty of a financial planner may be limited to just providing advise, whereas the position of a wealth manager may entail active management of a client’s assets. The consumer, who also stands to profit from the enhanced degree of control that is supplied, is placed squarely in the position of having a fiduciary responsibility as a result of this.

The establishment and upkeep of meaningful ties with one’s network of contacts is among the most essential components of effective wealth management. These connections may be with consumers, in addition to those with other financial advisers and experts who are actively involved in the process of putting up a comprehensive wealth management plan for a client. There are many instances in which the lines that demarcate the differences between the roles of financial planners, financial counselors, and asset managers are unclear and cloudy. This is shown by the situation in which an individual acts not only as a financial advisor but also as an asset manager. There are three types of professionals that provide consumers financial assistance, which may include suggestions about investments. Financial planners, financial counsellors, and asset managers are the names given to these specialists in the field. Personal financial advisers typically need to devote a significant portion of their available time to activities such as marketing their services, participating in activities on social media platforms, and networking with potential clients at events such as trade shows and seminars. These activities typically take up a significant portion of the time that personal financial advisers have available to devote to these activities.

The first few years of a financial advisor’s employment, particularly the first few years of their careers as younger advisors, are spent devoting a significant portion of their time and attention to the process of cultivating contacts with potential new clients. This is especially true during the first few years of their careers as younger advisors. It is standard practice for financial advisors to schedule at least one meeting per year with each client in order to keep clients informed of new investment opportunities and to modify a client’s financial plan based on the client’s circumstances or because an investment opportunity may have become unavailable. The purpose of these meetings is to keep clients informed of new investment opportunities and to modify a client’s financial plan. The purpose of these meetings is to update a client’s financial plan as well as to keep customers informed of any new investment options that have become available. The monitoring of the investment portfolios of their customers is one of the primary responsibilities of financial advisors. In addition, it is standard procedure for financial advisors to schedule at least one meeting with each client during the course of a single calendar year. Relationship managers are tasked with the dual responsibilities of maintaining strong relationships with existing customers while also being proactive in the search for new business opportunities. In addition to the conventional duty of maintaining connections with current customers, this will also be a responsibility. On the other hand, the maintenance of the investment portfolios of their customers, the compilation of progress reports on the performance of their investments, the conduct of appropriate research, and the supply of product recommendations are the responsibilities of investment experts.

A big part of a Director of Business Development’s responsibilities at a firm that handles money is to cultivate new client connections and assist in the acquisition of new business. In addition, this job contributes to the maintenance of the good connections that currently exist between money management teams and the customers of each team. In spite of the fact that this latter function is not usually the next step in the chain, the importance of this job cannot be overstated when it comes to developing new contacts with customers and assisting in the acquisition of new business. [Here’s a good example:] In addition to specializing in a particular field of expertise and being responsible for organizing the provision of services, wealth managers must also be able to identify and recruit qualified specialists. Despite the fact that wealth managers could have specialized knowledge in areas that are exclusive to them, this remains the case. These specialists, whose expertise is used in the provision of highly individualized solutions, include attorneys, accountants, bankers, and investment advisers, amongst others. Effective wages that are relatively high for entry-level positions are being provided by asset management companies and asset management divisions that are housed within larger institutions in order to compete with other employment opportunities in the financial sector that are currently available. These companies and divisions are housed within larger institutions. This is done in the hopes of luring in applicants who have the necessary qualifications for the vacancies. This is done with the expectation that it may entice candidates who are qualified enough to satisfy the standards.

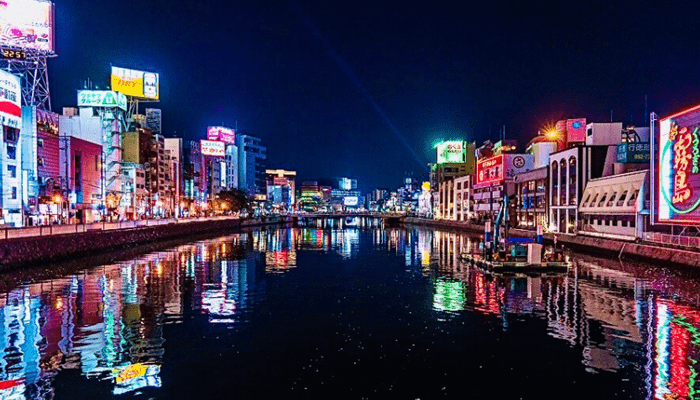

The following paragraph will be followed by a graphic that presents the results of a study that was conducted in February 2006 by Prince and Associates, a market research firm that specializes in private wealth all over the world. This study was carried out in response to the question, “Who has the most wealth in the world?” These results are shown in the image that comes after this text for your viewing pleasure. According to the results of the poll, the average wages of asset managers are almost twice as high as those of product experts and investment generalists combined. These are the findings of the survey. Asset management companies like Fidelity make investments with the money that is given to them by pensions, endowments, and other organizations that are similar in kind in order to work toward achieving their mission of generating a higher rate of return on endowment assets. This mission is to achieve a higher rate of return on endowment assets. These groups then transfer the funds to asset management businesses such as Fidelity.